We are pleased to present the results of our 2022/2023 Economic Conditions Survey. We asked over 8500 firms to comment on the economic environment in 2022, and what they expect in 2023. 2022 was “excellent” for 35% of our respondents, but only 13% expect the same in 2023. Our respondents gave insight on the biggest challenges facing their firms, whether they are requiring employees to be in the office full time, whether they will grow their employee headcount, the effects of rising interest rates, and other issues.

We appreciate the participation of those who answered our questions and we hope this survey gives you a valuable picture of what your peers are thinking and doing to be successful in 2023.

|

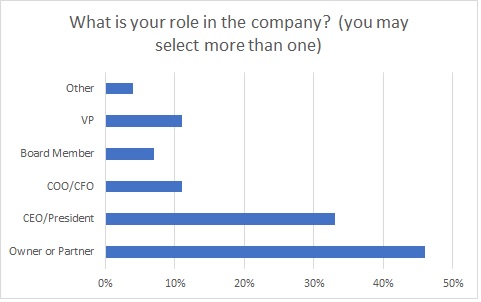

The majority (79%) of our respondents were either the CEO, President, or an owner or partner, meaning the data was accurate at the highest level of decision-making. |

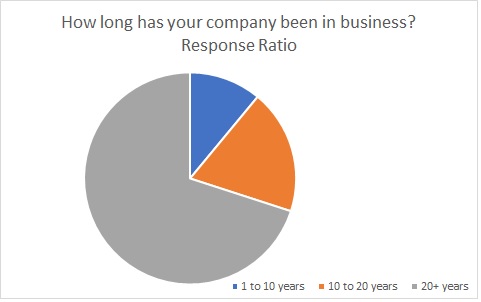

89% of respondents have been in business over 10 years, and 70% 20 years or more.

|

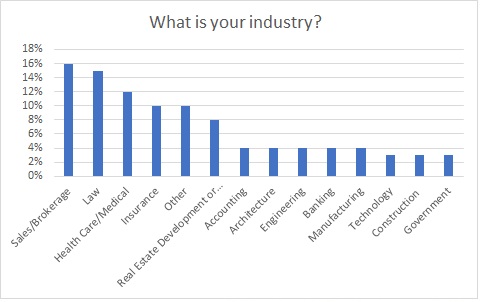

Our respondents came from a wide range of industries, including law, health care, accounting, banking, and others. |

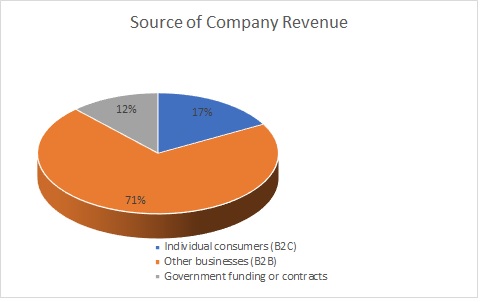

| Most of the firms – over 70% – conduct business to business (B2B) transactions. |

|

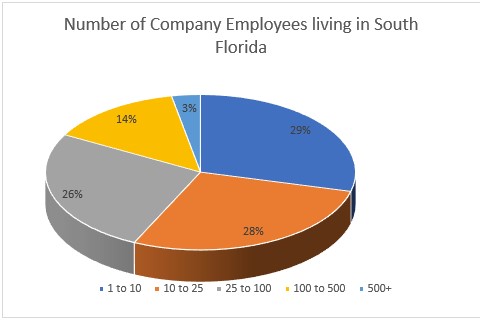

The firms ranges in size from under 10 employees (29%) to over 500 employees (3%), with the majority having between 10 and 100 employees. |

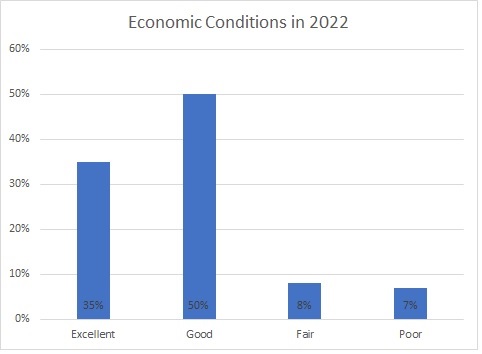

| Most respondents noted that economic conditions in 2022 were good (50%) or excellent (35%). This is encouraging given that we were coming out of a pandemic, with recession looming and interest rates climbing. But South Florida has been the beneficiary of extensive in-migration of people and businesses over the past few years, putting us “in a bubble” of optimism and growth not seen in many other areas of the country. |

|

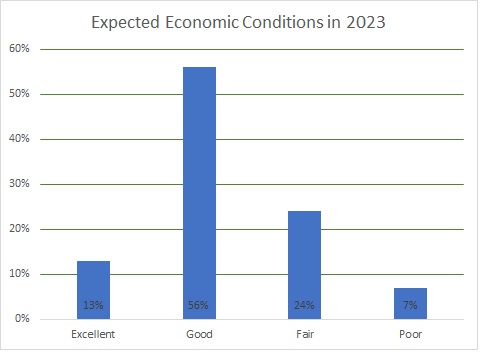

Our survey shows similar optimism for 2023, with 56% expecting “good” conditions, and 13% expecting “excellent” conditions. The same number as 2022 (7%) expects poor conditions, while the number anticipating fair economic conditions is higher, at 24%. Much of this is likely due to predictions of a pending recession, although South Florida still shows optimism and anticipates a favorable year. |

|

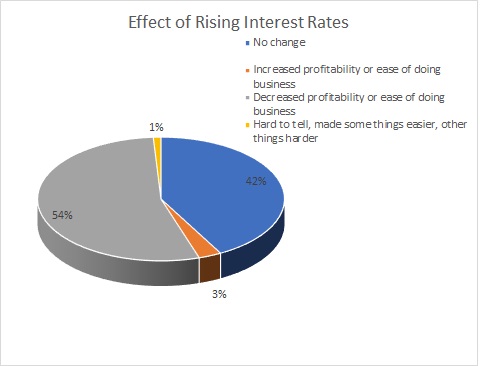

A slight majority of respondents (52%) say rising interest rates decreased their profitability, or made it harder to do business. This is not surprising, as everything from real estate loans to business capital costs have become significantly more expensive over the past year. Combine that with inflation and rising wages, and downward pressure on profitability is to be expected. However, a large portion of firms (42%) indicated that rising interest rates had no effect on their business. |

|

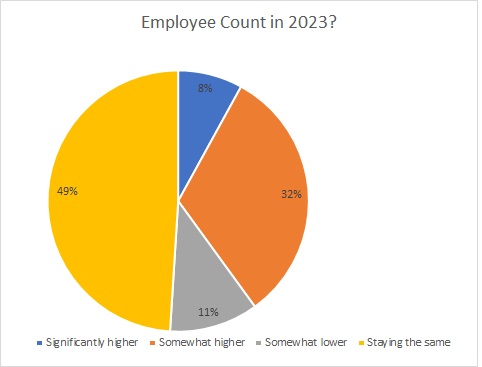

The relationship between employer and employee has been the focus of much Discussion this year. Where employees will work, rising wages, difficulty in hiring – these have all been topics of discussion in the media and in boardrooms. The first question is whether South Florida firms are hiring and growing. Nearly half indicated that their employee count will stay the same in 2023. But notably, 40% will be growing their headcount. Again, South Florida is, fortunately, in a unique position to grow given the influx of new residents and companies. |

|

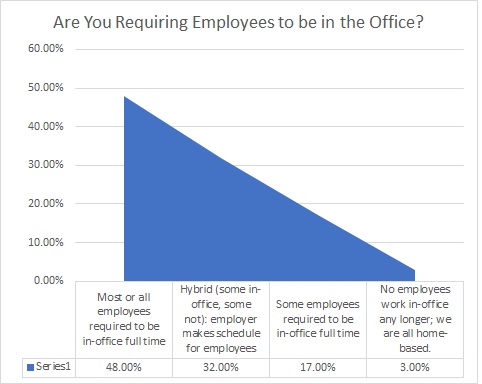

The question many employers struggle with is whether to require employees to work in the office, or allow them to work from home (or elsewhere outside the office). Kastle.com reports that office occupancy is up to 48.6% as of 2/13/2023, based on the markets they survey. But where your peers in South Florida on the issue? Our survey shows that similar to the Kastle data, 48% of responding firms are requiring all or most employees to be in the office full-time. Only 3% have gone fully virtual. 49% of respondents are somewhere in between, with some employees required to be in office full-time, while others are not or they rotate on a schedule. |

|

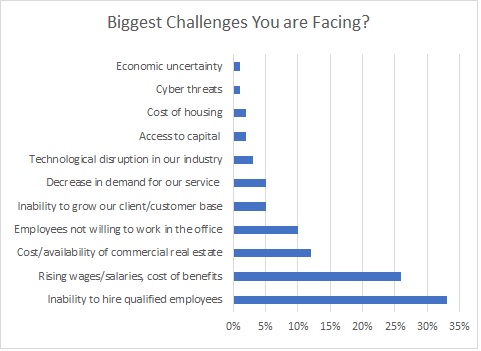

What challenges are your peers facing, doing business in South Florida? The largest problem (33%) is hiring qualified employees. This seems to be a problem nationwide. The second most prevalent issue (26%) is the rising wages, salaries, and cost of benefits. Following these were the cost/availability of commercial property (12%), and employees not wanting to work in the office (10%). Additional challenges are listed in the chart. |

| We hope this data is helpful in assessing your own experiences doing business in South Florida. The overriding messages we take from the survey are the optimism for positive conditions going into 2023, and that most employers are facing challenges with employees – from hiring, getting them to work in-office, to wages and benefits. We are always available to discuss how you can reconfigure your offices to conform to changes in usage and demand for space. Thank you for those who participated in the survey, and best of luck to everyone for a successful year in 2023! |