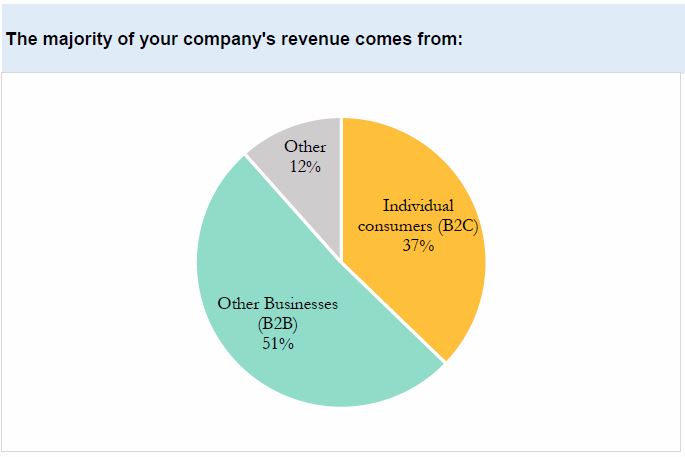

We are pleased to present the results of our 2018/2019 Economic Conditions Survey. We asked over 2500 firms to comment on the economic environment in 2018, and what they expect in 2019. 2018 was “excellent” for over 1/3 of our respondents, but less than 1/4 expect the same in 2019. Our respondents gave insight on the biggest challenges facing their firm, how severe the end of the economic cycle will be and when they expect that to happen, whether they are growing or downsizing (employees and facilities), whether investment back into the firm is increasing and what they are investing in, whether profits are up or down, and how they reach customers. The responses were enlightening, to say the least, and a brief overview of the respondents’ collective background will be helpful in putting the data into perspective.

Who Were the Respondents?

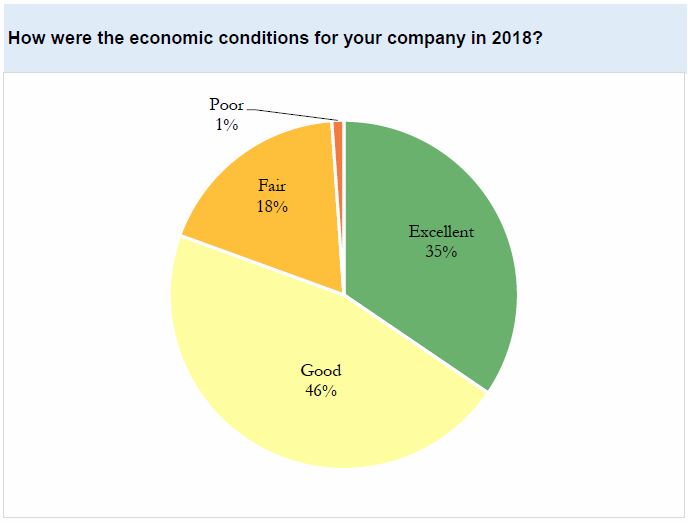

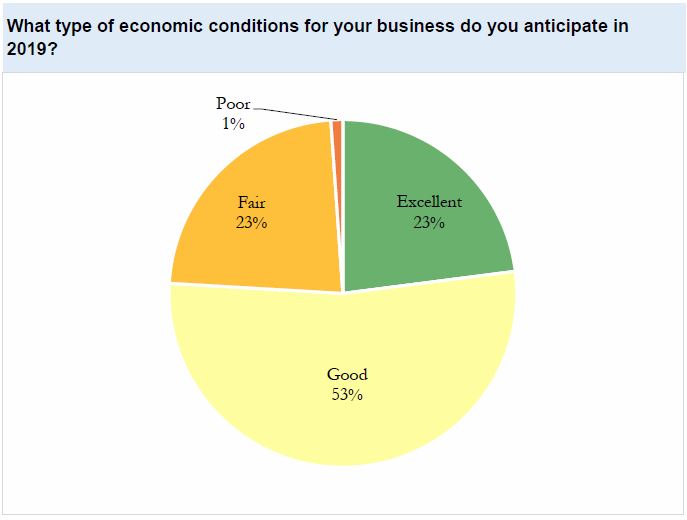

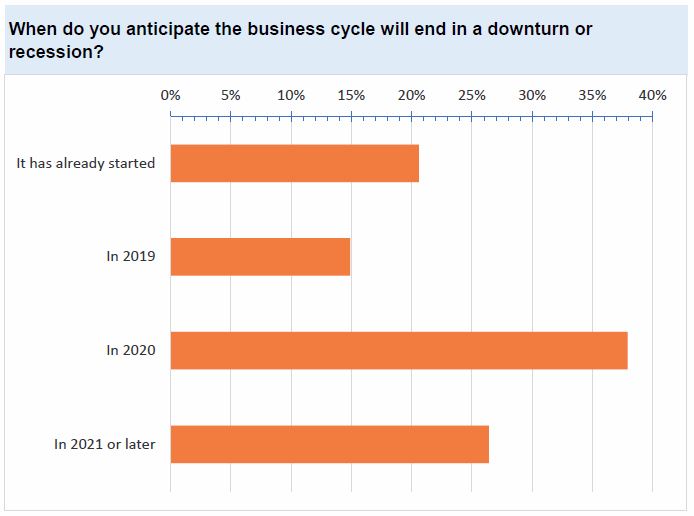

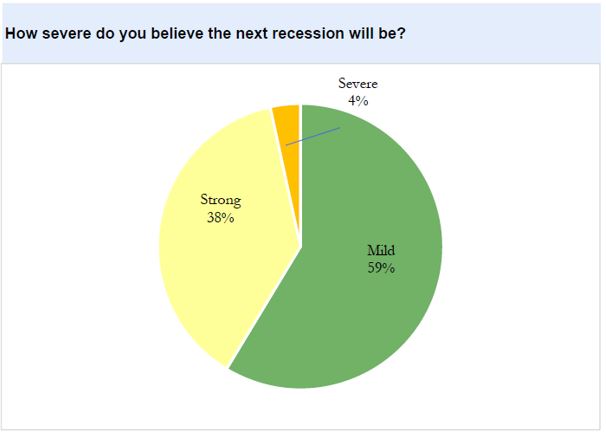

How was the Economy Last Year, and Where are we Headed in 2019? Most respondents believed that economic conditions for their company were either excellent (35%) or good (46%) in 2018. Most are optimistic about 2019, but only 23% believe it will be excellent. Only 1% believed the economy was poor in 2018 or will be poor in 2019. The majority (64.3%) believe that an economic downturn or recession will come in 2020 or later, while 20.6% believe it has already begun. 58.6 believe that the next recession will be mild, while only 3.4% fear that it will be severe.

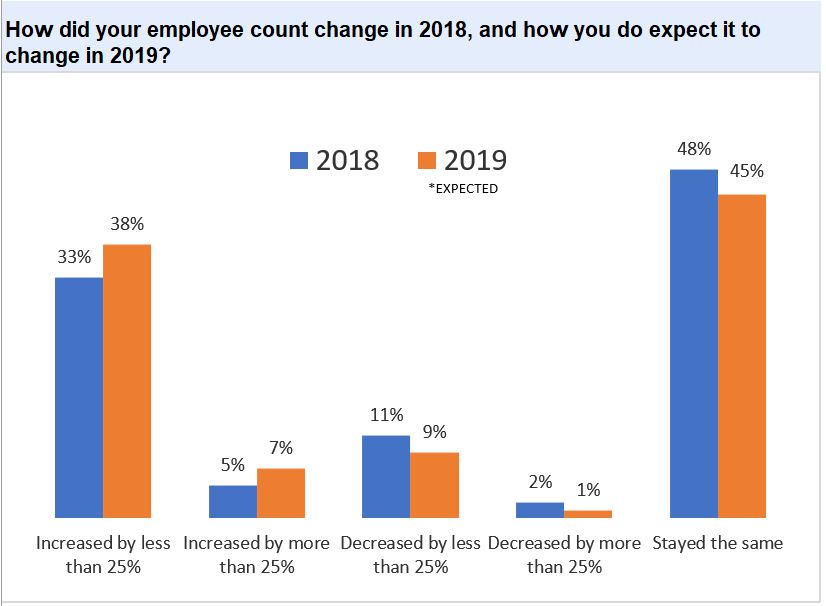

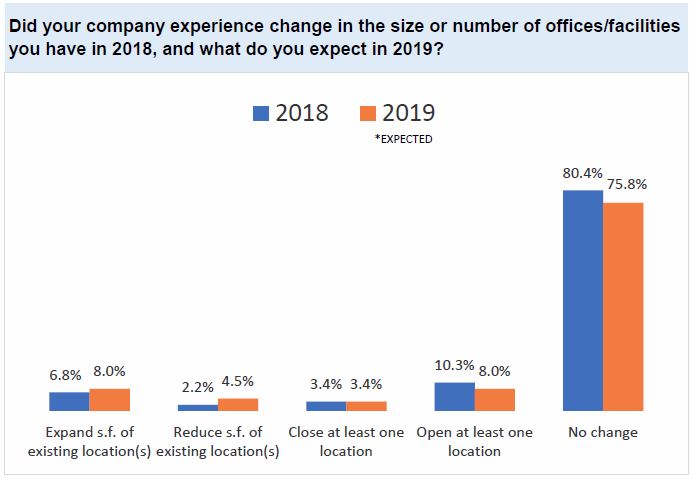

Did They Grow (People and Places)?

Our respondents did not report excessive growth in people or facilities last year, nor do they anticipate excessive growth in 2019. 80.4% reported no change in the size of their occupied real estate or number of locations in 2018, and 75.8% expect the same in 2019. Only 4.5% reported employee growth over 25%, while 48.2% reported no change last year. But surprisingly, nearly 38% anticipate employee growth to exceed 25% In 2019, and only 44.8% anticipate no change.

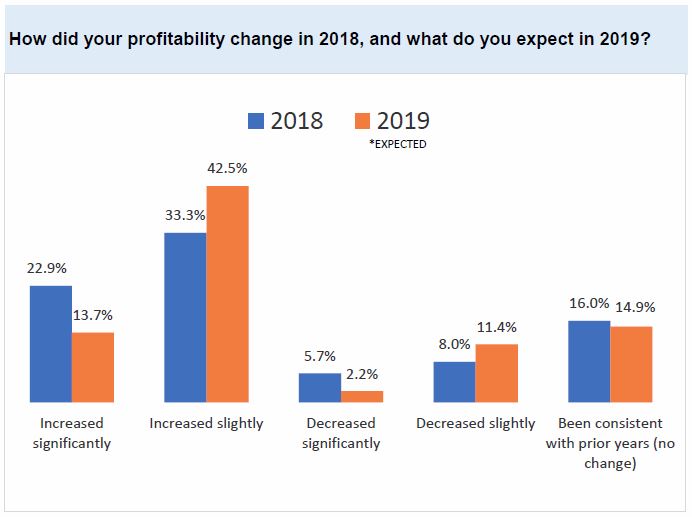

Did They Grow (Profits)?

56.2% of our respondents reported that their profitability increased in 2018 (either slightly or significantly), and the same percentage is expected it to increase in 2019. The difference was those who experienced significant growth (22.9% in 2018) and expect significant growth (13.7% in 2019).

We asked what the change in profitability was attributable to in 2018, and received some interesting answers, reflecting reasons for growth or contraction:

• Insurance reimbursement rates to physicians going down

• Restructuring of business relationships

• Working smarter

• Strong demand

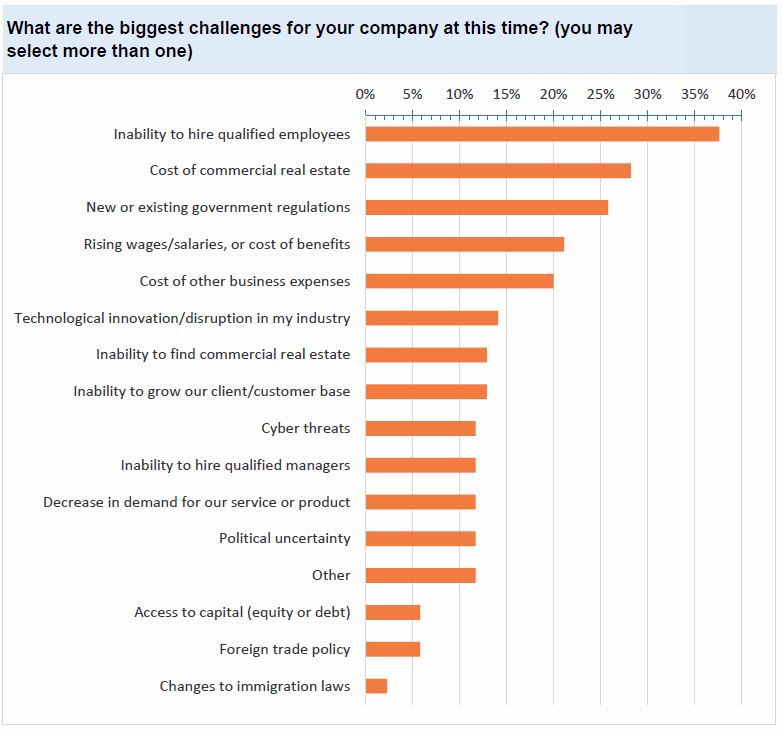

Challenges

What headwinds did businesses face in 2018? When we asked our respondents to identify the biggest challenges facing their company, over 37% chose “Inability to hire qualified employees.” This is something I hear often from my clients and associates. Other responses are shown below.

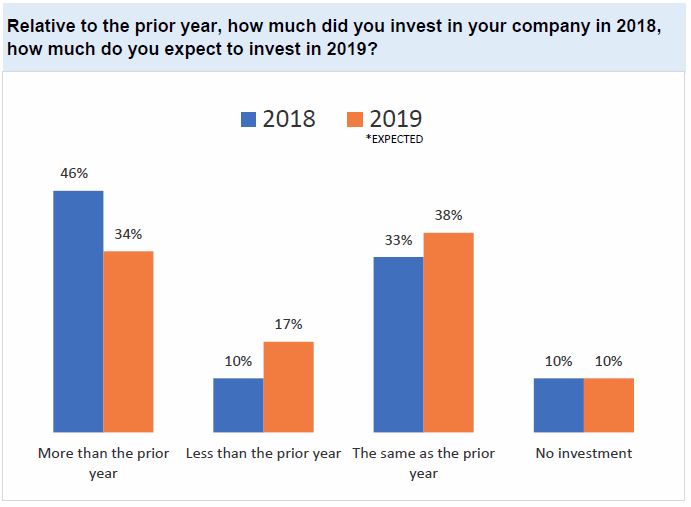

Investment Back into the Company

Firms continue to invest back into the business. In 2018, 45.9% of respondents indicated that they invested more in 2018 than 2017, and 34.4% indicate that they will invest more in 2019 than 2018. Only 10.3% invested less in 2018 than the prior year, and only 17.3% will invest less in 2019 than 2018.

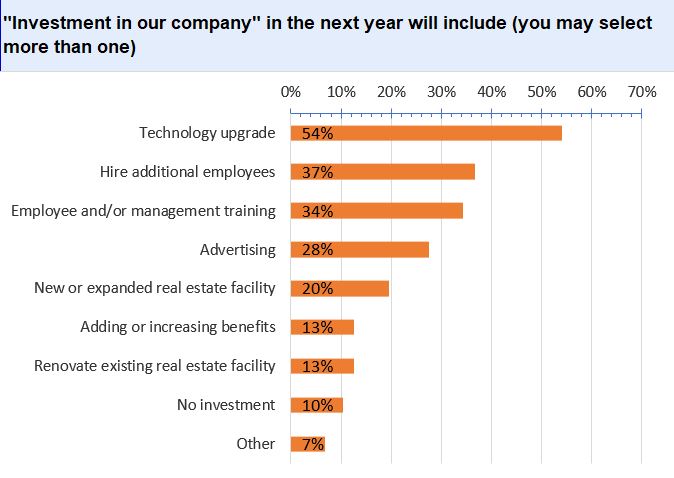

What are they investing in? We allowed respondents to choose more than one answer, as the choices were not mutually exclusive. Over half of the firms will be investing in technology upgrades. Over a third will focus on employee or management training. And over a third will be hiring additional employees. Over a quarter will invest in advertising, and nearly a third will be expanding or renovating their occupied real estate.

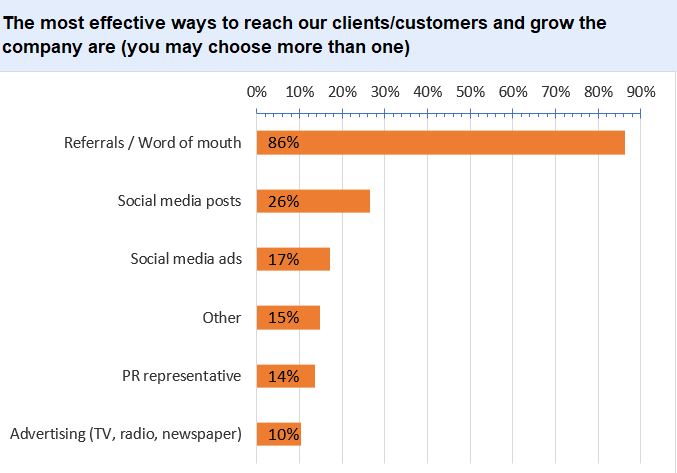

How They Reach Their Customers

Finally, we asked how these companies are effectively reaching customers to grow. The vast majority (86.2%) identified referrals/word of mouth as the best way. Social media posting was a far second, at 26.4%, while social media ads were third at 17.2%. Other responses are in the graph, below, and “sales people” and “brokers” were among the write-in responses.