Office rents continue to rise in South Florida, and there are two good reasons why this will continue for the foreseeable future. First, supply is constricted. Second, the sale of office buildings at record prices forces new owners to charge higher rates.

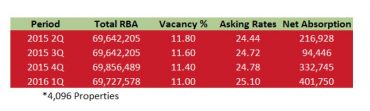

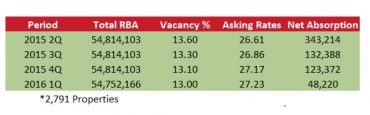

As companies continue to expand in South Florida, the existing supply of office space is being leased. Our first quarter market reports for Broward and Palm Beach Counties showed positive net absorption (more space is being leased than is coming on the market) for 4 straight quarters. In addition, vacancy rates went down over that same 12-month period. With no significant new construction, and space being absorbed, the laws of supply and demand dictate that pricing for office space will rise. Our market reports showed that, as well. Rates increased over $0.50/s.f. in both counties in the past year.

We do not expect any new office properties to be built in the near future, as long as apartment developers continue to outbid office developers for land. But there are signs that the apartment boom won’t last forever. The Daily Business Review, on May 26, 2016, reported, If there’s any doubt that South Florida’s real estate boom is slowing, take a look at the region’s latest construction data showing construction activity plunged in April. Nonresidential starts dropped to $117 million last month “ a dramatic 71 percent decline from April 2015. Residential starts amounted to $321 million, or 35 percent less than a year before. Once apartment developers stop their furious pace of construction, there will hopefully be sites left for new office development, and if demand is high enough, they will be built.

The second basis for increasing rates is the froth in the market for the purchase of investment properties. With the Federal Reserve holding interest rates down at artificially low levels, it is easy for investors to borrow and purchase commercial real estate. In addition, because returns on other investments are also at such low levels, investment funds continue to flow into commercial real estate at a fast pace, in search of higher returns.

Sumitomo Corp. of Americas purchased the office building and air rights to the Miami Tower, 100 SE 2nd Street, Miami, for $220 million, or $357 per s.f., according to the Daily Business Review, May 24, 2016. In the same DBR edition, it was reported that Renaissance Aventura, LLC, paid more than $417 per s.f. for the Aventura Corporate Center, a three building office park close to the Aventura Mall, at 20801 “ 20807 Biscayne Boulevard. With investors purchasing at such high prices, they will have to raise rents in order to achieve reasonable returns. In addition, sellers are raising rents prior to putting their properties on the market, in order to maximize their sale price. This cycle will continue to drive rents up.

It would be best to lock in a long term lease, at the lowest possible rate now, rather than take your chances in a year or two or when your lease is closer to expiration. If you or your broker had the foresight and leverage to lock your renewal rate in at a fixed increase over the last year, or at a discount to market rents, then you could be better protected from rising rates. If not, contact your broker to discuss a new strategy to keep your rates down.