Download Full PDF Report

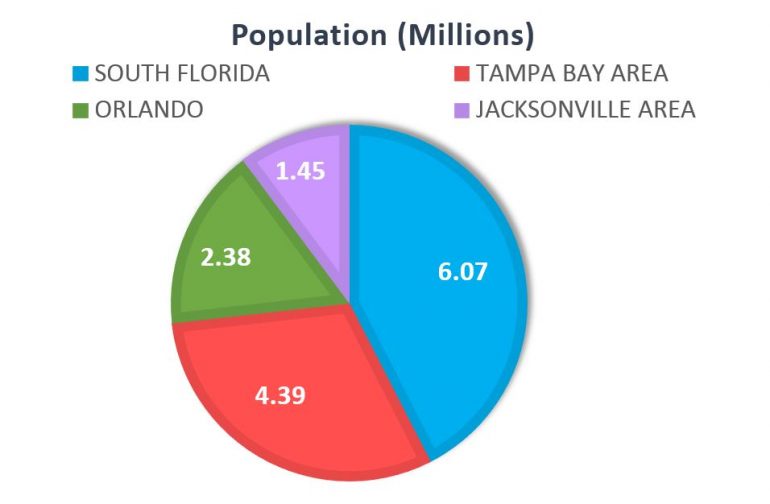

We are pleased to provide you with this copy of Berger Commercial Realty Corp.’s 2017 forecast for the South Florida and U.S. commercial real estate markets. To help you prepare for your involvement with commercial real estate, we address several key areas: investments, new development, the economy, lending, and, of course, the major property sectors that we service, office, industrial, and retail. We rely on multiple sources for our forecast, all listed at the end of the report. We hope this information is informative and useful. If you have any questions, please contact our brokers and we will be happy to assist you.

Real Estate Investment

The investment market should continue to be robust in 2017, as foreign investors seek U.S. assets even as REIT’s are selling. Cap rates and yields should stay low in most sectors, and it will be difficult to find value add properties, or core investments, at a reasonable return. Strict lending practices and higher interest rates will slow investment somewhat. Given the low-yield, higher-interest rate environment that many predict, we believe you will see the following trends this year:

• Investors will turn to skilled property management and leasing firms to lower costs, and increase income from their properties.

• Both large (institutional, REIT) investors and small (individual, family funds) will have difficulty locating well priced properties to purchase, leading large investors to hold cash, and small investors to hold their existing portfolio longer than they’d like, unable to complete 1031

exchanges.

• Foreign investors will continue to invest in U.S. assets, slowed somewhat by the strengthening dollar. South American investors will shift their focus in South Florida from residential to commercial, in search of higher returns.

• Investors from the northeastern U.S. will sell assets in their home states and look for assets in South Florida, and elsewhere in the country, seeking higher returns. If the dollar weakens, which the new presidential administration has signaled they prefer, this will favor foreign investors.

• Primary markets and central business districts will fall out of favor with some investors, who will look to secondary and suburban markets for higher yield and value-add properties.

• Investors may seek higher returns in alternative sectors, such as student housing, senior living, and self-storage – areas where most investors are not yet very active.

• Investors who can make quick decisions, and close fast, will find more opportunities than others.

New Development

New development will vary by sector. It will be hampered to some extent as banks tighten up lending, particularly construction loans, where they fear potential over-building. Stricter federal lending standards will exacerbate the issue, preventing some projects from ever going beyond the planning

stages. We expect the following trends in 2017:

• New construction will slow down, as some fear we may be coming to the end of the current real estate cycle. In South Florida, this is mainly going to be felt in multifamily/rental apartments, where most of the construction activity has been.

• In the central business districts, there will be more of a focus on “live-work-play” development, as more employees choose to live close to work, and demand for amenities will increase.

• Expect to see smaller, more efficient office spaces, as technology changes the way we work. Firms will need less space now than they did in the past, and millennials will function better in “communal” workspace.

• The Internet of Things (IoT) will bring technological advances and increased efficiency to commercial properties, improving experiences for employees and building owners.

• Tightening lending standards will stifle new construction, keeping supply low and rents high.

• Retail spaces will be repurposed, as more big-box retailers close, leaving large vacancies in retail properties. Owners will need to find alternative uses or risk losing the properties. Think: Macy’s, K-Mart, and Sears, closing hundreds of locations.

• New industrial development will continue, with some constraints due to the lack of available development sites, as online retail sales grow and more distribution space will be needed to keep up with e-commerce.

The Economy

Are we headed for recession this year? It seems unlikely, unless there is some outside event that disrupts the economy. The four phases of the real estate cycle are 1) Recovery, 2) Expansion, 3) Oversupply, and 4) Recession. Regarding those phases, we make the following observations:

• We have been in the Recovery phase since coming out of the Great Recession, and in some sectors (multifamily and now industrial) we have been firmly in the Expansion phase and may be coming to Oversupply (multifamily).

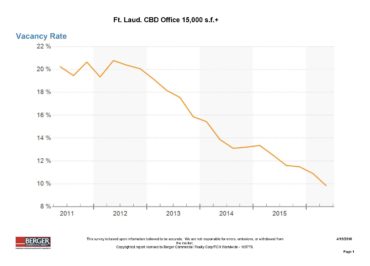

• Other sectors, office in particular, remain in the recovery phase and we are not likely to see much oversupply in 2017.

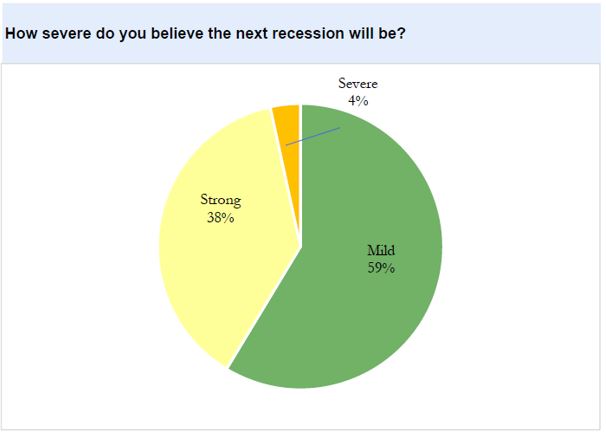

• Tight lending standards, particularly construction lending, has forced discipline on most developers, preventing the rush to development and ensuing oversupply that we have seen in past cycles. This may allow for a “soft landing” when we do come to the end of this cycle.

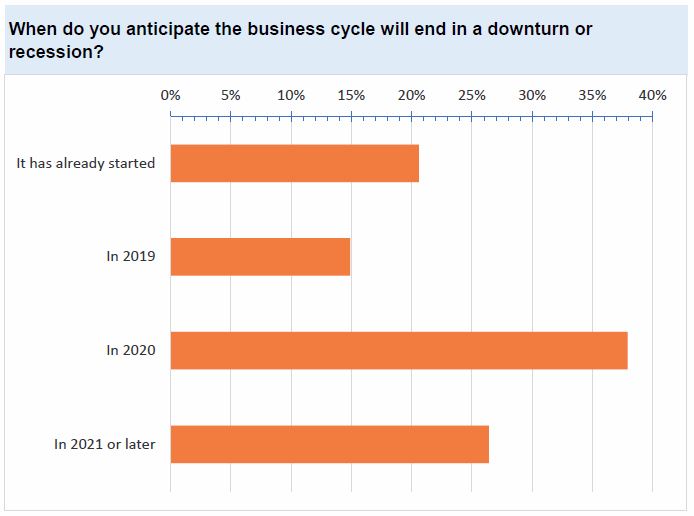

• There is no doubt that this has been an unusually long real estate cycle, and what goes up must come down. We expect the cycle to reach Oversupply and Recession at some point, but it’s not likely to happen in all commercial sectors in 2017 given lessons learned from the past. Some

believe we may have another two years left in this cycle. Others have already begun putting cash aside, anticipating property values (and purchase prices) dropping once a recession hits.

• Job growth will continue, but there will be some uncertainty and delayed decision making with the incoming Trump administration’s new business agenda, as well as rising interest rates. If rates rise too quickly, that could speed up the next recession.

• Energy prices should remain low (barring a major war in the Middle East), and this will keep the cost of operating commercial real estate low. It also will keep more disposable income in the pockets of consumers, shoring up retail spending.

Lenders

The list of lenders who were either forced into bankruptcy or were acquired during the Great Recession is quite long. A big factor in these failures was poor lending practices, and banks (with some pressure from the U.S. government) are determined not to repeat the same mistakes.

• Stricter lending requirements will push LTV (loan to value) ratios lower, forcing investors to put up more cash to purchase investment properties.

• Tight federal regulations will make borrowing even more difficult, bringing some unwanted (but possibly necessary) discipline to the market, and keeping investors from creating another real estate “bubble.”

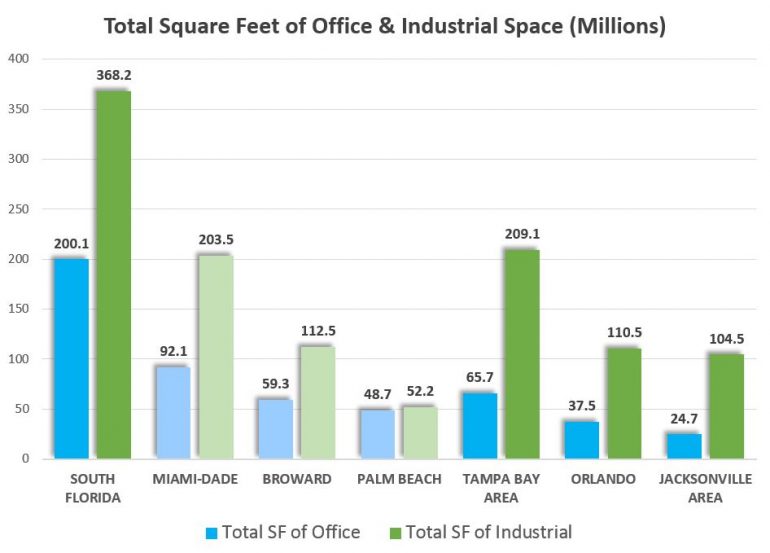

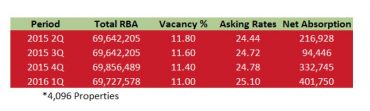

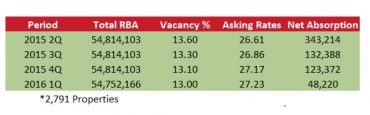

Office

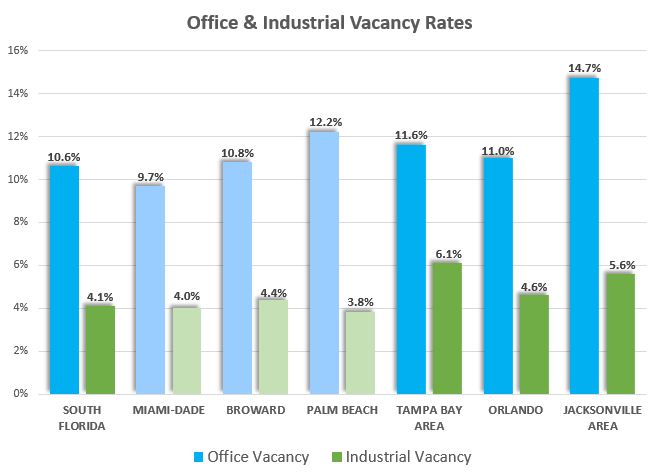

In addition to the general trends we are forecasting, above, each sector of the commercial real estate market should see its own, unique set of circumstances that will affect performance in 2017. The office sector is changing. Tenant demand for more efficiency and flexibility in workspaces is forcing changes in how office space is configured. With little new construction, and demand catching up with supply, rents will continue to rise this year.

• Tenants have carried over money-saving habits from the Great Recession and will continue to design their spaces for greater efficiency – trying to fit more people into less square footage, straining building systems and parking.

• In some cases, corporate tenants will forego long term leases for the flexibility of “shared workspaces” such as WeWork. The flexibility in the number of seats leased and lease term will attract growing firms and accommodate the millennial workforce.

• Investment in office properties will slow – the capital required for re-leasing space (commissions, rent abatement, tenant improvements) and improving building common areas and systems takes too long to recover with a recession potentially around the corner in the next two years. • We expect little or no speculative office construction this year. Lenders are shying away from construction lending, and demand has not risen enough to justify it. Properties can be purchased for below replacement cost, given the high cost of land in most locations.

Industrial

Industrial developers have been active this year, with new construction being absorbed almost immediately, keeping vacancy rates around 5%. Several factors in 2017 will keep this trend going.

• “Last mile” delivery will become increasingly important, as e-commerce sellers struggle to speed up the delivery process. For same-day delivery to become a reality, sellers such as Amazon will need multiple local properties for distribution. These can be served by existing or new construction industrial properties, or by non-traditional warehouse (e.g., repurposed office or retail properties) as deliveries will be done by van, box truck, or even by drone (maybe not this year, but soon). Whatever property type, location near population and business centers will be key.

• Investment will grow as a favored investment type. Re-tenanting is less costly than other property types (i.e., office), and demand is high. Rent growth will contribute to higher yields.

• In South Florida, new development seems to be taking place mostly in Broward County, and this should carry over through 2017.

Retail

Retailers are feeling the competition as online sales grow each year. Big box retailers and department stores are closing multiple locations across the U.S. Macy’s announced it will close 68 stores in the first half of 2017. Sears will be closing 150 Sears and Kmart locations in the first quarter. Retail landlords will have to find a way to backfill these spaces. We expect this to bring many changes to retail properties.

• Property owners (or tenants, if still under lease) will have to find creative uses for the soon-tobe vacant spaces if they cannot be released as retail. Conversion to office, “last mile” delivery distribution (see Industrial, above), or entertainment centers that will attract shoppers, are possible re-uses we may see this year.

• Retailers will provide online portals for internet shopping in the stores, bringing customers in and still capturing sales.

• Retailers and property owners will find ways to enhance the customer experience, in order to draw them to physical stores. Live music, more/better restaurant choices, and anything else that will make shoppers happy, should work.

• Online sales will increase, leading consumers to spend even less time in “brick and mortar” stores. But online retail will not completely do away with physical stores – not in 2017, and not ever.

• Investment in power centers (with big box anchors) and malls (with department store anchors) will slow, until investors feel that store closings are a thing of the past.

Conclusion

2017 should be a good year in commercial real estate, with more transactions, but no froth. Investors will find areas where yields have not been compressed by competition among buyers. New development and lending will both remain muted, helping to ease this real estate cycle to a

soft landing when it does come to an end. Investment in the office market should slow down among domestic buyers, but not foreign buyers, while office rents should continue to rise. In the industrial sector, demand will continue to grow among tenants and investors, as this sector should outperform the others. Retail properties are in for a bumpy road, as store closings and online sales bring long term change to the retail landscape.

Berger Commercial Realty Corp. is here to guide you through the year, whether you are an investment buyer or seller, a landlord or tenant. Our experienced advisors and property managers will help you make sense of the year to come and maximize the return on your investment in real

estate. We look forward to working with you this year. Thank you.

Sources:

Deloitte.com, Commercial Real Estate Outlook 2017, December 2017

TheRealDeal.com, Experts Forecast the Sate of Miami’s Real Estate market in 2017: Panels, November 17, 2016

Urban Land Institute and PWC, Emerging Trends in Real Estate 2017, October 2016

Download Full PDF Report